Northeast Florida Real Estate Trends for 2024: Achieving Stability

In the anticipated scenario of interest rates dropping in 2024, Northeast Florida's residential real estate landscape is poised for potential shifts, enticing both sellers and buyers to engage in transactions with increased enthusiasm. The upcoming year may witness a dynamic interplay between supply and demand, influenced significantly by evolving interest rates. As projected decreases in interest rates loom, sellers and buyers alike are likely to find themselves more inclined to pursue real estate transactions, drawn by the enhanced financial incentives. Affordability emerges as a pivotal consideration amidst these anticipated fluctuations in market dynamics. Against the backdrop of shifting prices, the Northeast Florida Association of Realtors (NEFAR) presents compelling insights into the region's real estate trajectory, tracking data across Baker, Clay, Duval, Nassau, Putnam, and St. Johns counties.

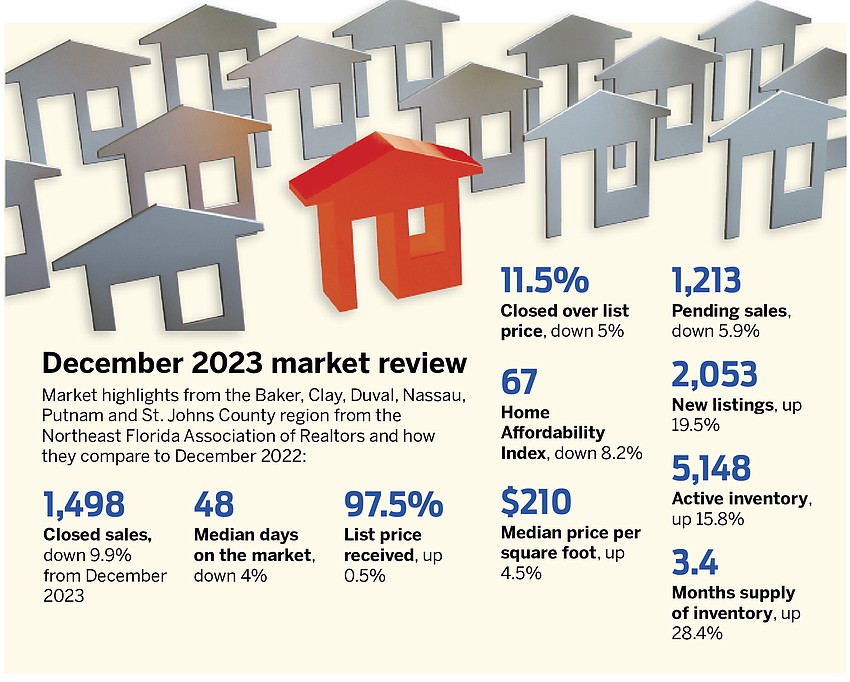

In the period spanning January to December 2023, NEFAR's data reveals a noteworthy appreciation in the median price of single-family homes, surging by over $23,000. Commencing the year at $360,990, the median price climaxed at $384,750 by year-end, peaking at $395,000 in July. A nuanced analysis of market trends indicates a subtle yet discernible shift in the balance of power between sellers and buyers throughout the year. This evolution is underscored by fluctuations in the median number of days properties spent on the market. Notably, the duration decreased from 57 days in January to 48 days in December, with notable troughs observed in May and August at a mere 33 days. The fourth quarter witnessed a stable range of 43 to 48 days.

Realtors attribute the extended duration for closing deals to heightened inventory levels, suggesting that buyers are exercising greater diligence in their decision-making processes. This stands in contrast to the frenetic pace witnessed in 2020, where houses were snapped up within days, propelled by a combination of limited supply and robust cash purchases from both out-of-state buyers and corporate entities investing in rental properties.

Diana Galavis, the 2023 president of the Northeast Florida Association of Realtors, suggests that with the potential influx of more inventory onto the market and the stabilization of interest rates, buyers may find themselves with the luxury of time to explore their options more thoroughly. Additionally, the Home Affordability Index, as defined by NEFAR, could signal a positive trend for buyers in 2024. This index evaluates whether the typical family earns enough to qualify for a mortgage on a typical home, considering factors such as current interest rates, median income, and median home prices. A higher index number indicates greater affordability, with NEFAR indicating that a value closer to 100 or higher is advantageous for buyers. Starting the year at 73, the index experienced fluctuations, reaching a low of 63 in November before rebounding to 67 in December. Rory Dubin, the 2024 NEFAR president, highlights the importance of monitoring this index, noting that while the year-over-year changes may not be significant, the month-over-month trend is promising.

Dubin elaborates on specific regional trends, noting a particularly positive shift in affordability in the Beaches area, where the index surged by 17%. This uptick bodes well for buyers, signaling favorable conditions in an area traditionally known for higher overall costs compared to Duval County. In November, the Beaches index stood at 36, rising to 42 by December. Throughout the year, the index peaked at 47 in February and hit a low of 34.5 in September. Anticipation of potential interest rate reductions toward the end of 2024 could further stimulate activity among both buyers and sellers. Meagan Hart Perkins, the 2024 president of the Northeast Florida Builders Association, highlights the reluctance of some homeowners to sell, citing the allure of holding onto mortgages with rates below 3%.

"If interest rates begin to decline, I'd be more inclined to list my current home for sale and move into my forever home instead of staying in my starter home."While locals might experience sticker shock when searching for a new home, buyers from larger metropolitan areas, California, and the Northeast perceive Northeast Florida as a bargain. According to Dubin, "Northeast Florida remains one of the more relatively affordable places not only in terms of affordable housing, but also in terms of how much house or property value you get for what it costs, relative not only to Florida but also to the Southeastern United States."

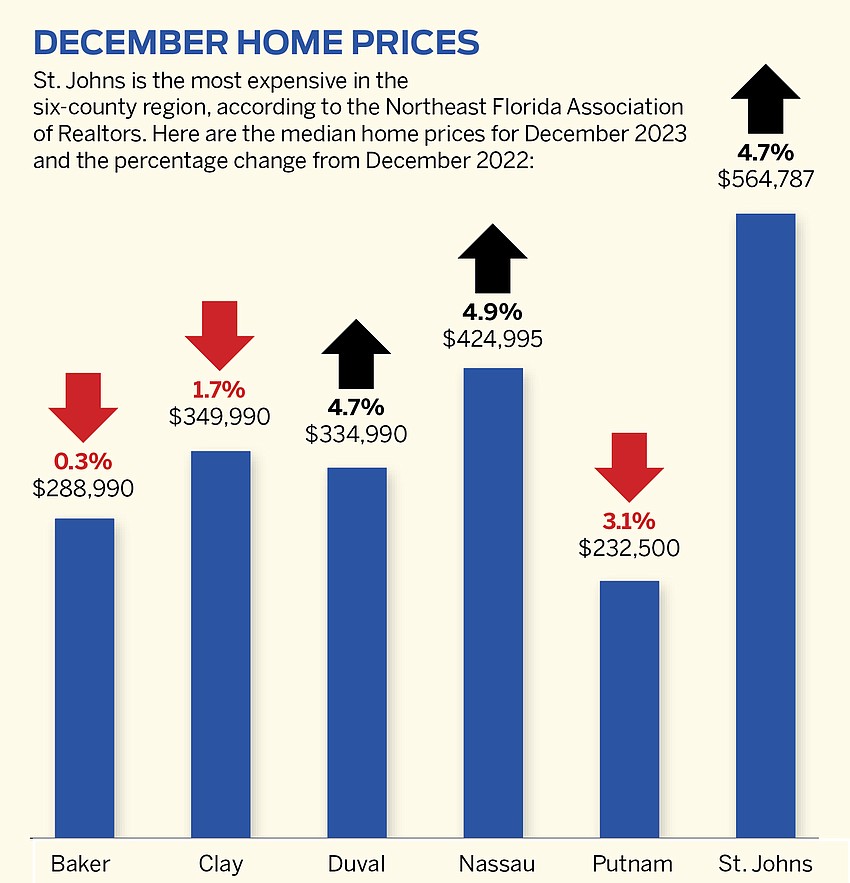

St. Johns County retains its status as the most expensive area in the region. Starting the year at $528,245, the median price rose to $564,787 by year-end, peaking at $585,000 in July. However, there were declines to $510,000 in both February and November. Nassau County follows as the second-most expensive. The median price in 2023 began at $384,318, reaching $424,995 by December, with a peak of $449,883 in November. It dipped to $368,480 in February but remained above $400,000 for nine of the last ten months. Duval County witnessed a steady increase, starting at $308,750 and ending at $334,990.

Clay, Baker, and Putnam counties maintained relative stability throughout the year. Clay County's median price started at $370,000 in January and finished at $349,990 in December, with a low of $339,995 in April. Baker County began at $285,495, ending at $288,990, peaking at $305,500 in October, and hitting a low of $275,000 in September. Putnam County was the only area with a lower median price at the year's end, starting at $245,995 and finishing at $232,500 in December, peaking at $260,490 in June, with a low of $200,000 in February. The National Association of Realtors predicts a 14% increase in sales of existing homes in 2024, from 4.1 million to 4.7 million. NAR Chief Economist Lawrence Yun anticipates that metro markets in southern states will outperform others due to faster job increases, while markets in the Midwest will benefit from being in the most affordable region. Yun also expects a 30% increase in supply as existing homeowners return to the market due to lower inflation, interest rates, and reduced concern about a recession.

Categories

Recent Posts

.jpeg)

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "